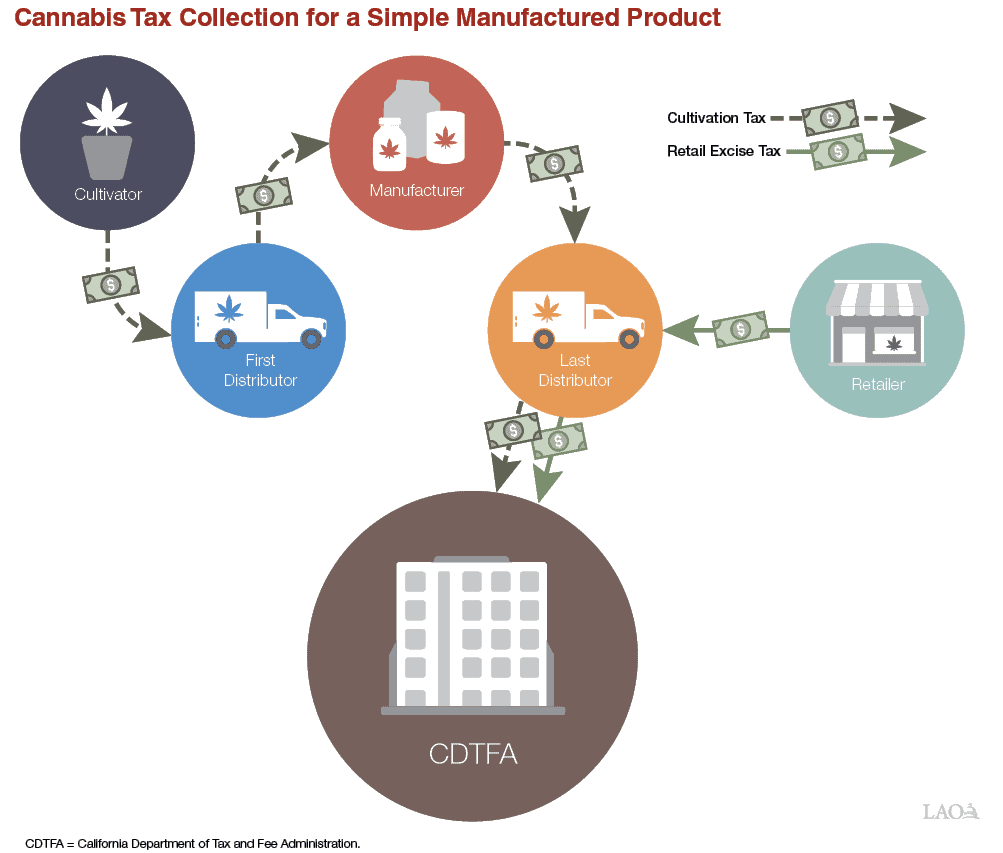

November 22, 2021 – The California Dept. of Taxation and Fee Administration has ruled that the cultivation tax on legal cannabis be raised from $9.65 to $10.08 per dry-weight ounce of flower, from $2.87 to $3 for leaf, and from $1.35 to $1.41 for fresh material starting on January 1, 2022.

California Should Be Reducing, Not Increasing Cannabis Taxes

Cal NORML denounced the tax hike as wrong-headed and untimely. “The legal industry is already so burdened by excessive taxes and regulation that it cannot compete with unlicensed marketers,” says California NORML Director Dale Gieringer. “California needs to be reducing, not increasing cannabis taxes to make the legal market more competitive.”

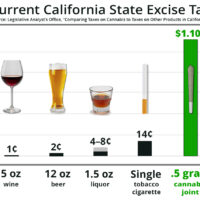

The cultivation tax is especially burdensome on licensed farmers, who are struggling from a price collapse due to overproduction. Wholesale prices for outdoors flower have plummeted 60% in the past year to as little as $200 – $500 per pound according to MJBizDaily.com. At this rate, the new cultivation tax amounts to a whopping 30% – 80% of the cost of production. Even after the tax has been paid, producers have no assurance that the crop will ultimately be sold. Meanwhile, the costs are passed along to consumers and magnified at every subsequent stage of production.

The CDTFA is authorized by law to adjust the cultivation tax yearly in line with inflation; in the case of cannabis, however, prices have collapsed, not inflated.

“The cultivation tax was designed to bolster prices against a possible collapse in the legalized market,” says Gieringer, who once supported it. “The fear was that if cannabis became as cheap as comparable herbal products like tea, the price could drop to a few dollars per pound, or just pennies per joint. In actuality, however, California’s costly taxes and regulations have raised the price for legal cannabis substantially above what it was prior to legalization.”

A 2020 poll of Cal NORML members found consumers want lower taxes on cannabis, with 76% of respondents naming it as their top legislative priority. Prop. 64’s taxes and local restrictions sent many Californians back to unlicensed and untested suppliers when it took effect in 2017, leaving many medical patients and others without a safe and affordable source for cannabis, and fueling the illicit market.

“California has no need for further cannabis tax money. The Legislative Analyst’s Office has estimated that the state will have a budget surplus of $31 billion next year. The cultivation tax is particularly onerous and cumbersome to administer. We urge that it be eliminated,” said Gieringer.