UPDATE: CDTFA will host a Microsoft Teams meeting on 8/29/24 at 10 AM on Emergency Regulation 3802, whereby the excessive state excise tax of 15% is applied to non-cannabis items like vape batteries, if sold as part of package.

Read more and sign up to attend the meeting.

CDTFA says, “The Department did not intend for draft emergency Regulation 3802 to expand the base of the cannabis excise tax imposed by RTC section 34011.2 to generally include all gross receipts from sales of tangible personal property subject to sales and use tax. The Department agreed with the interested parties’ comments regarding charges for services and transportation [only]. Therefore, the Department revised emergency Regulation 3802’s provisions regarding those charges accordingly.” Read More.

Under the Adult Use of Marijuana Act, the cannabis excise tax is set at 15% of gross receipts from licensed retail cannabis sales in California. Many local governments impose additional taxes on cannabis, ranging as high as 10% in some jurisdictions, including Los Angeles.

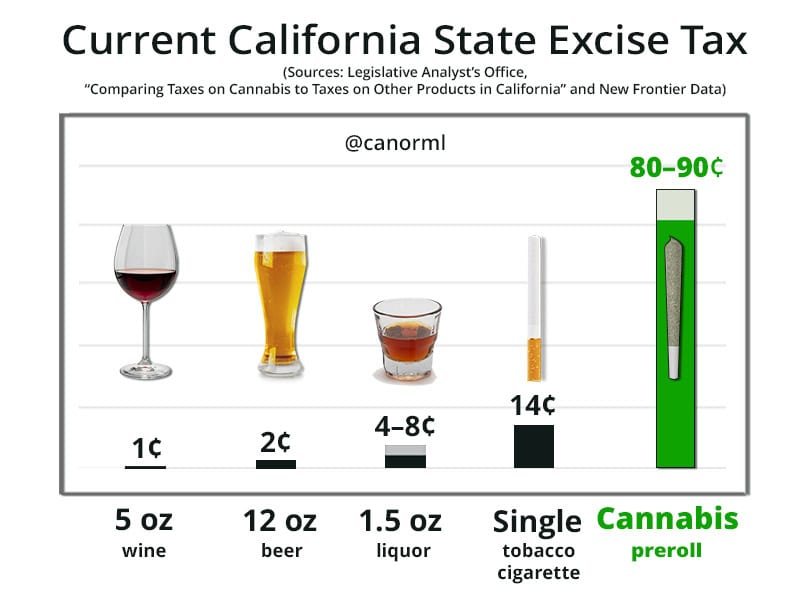

Cannabis is heavily overtaxed relative to comparable goods in California. Adding the sales and use tax of 7.25% to 10.5% on top of the excise tax raises the cost of a joint by another 8 – 11 cents—more than the total state excise taxes for an alcoholic beverage. If local cannabis taxes are added in, the difference ranges as high as 18 cents.

Local governments are currently required to include state and local excise taxes in the definition of “gross receipts” when charging additional sales taxes of 7.25 – 10.5%. A bill, SB 1059 (Bradford) to end ongoing double taxation of cannabis in California has been introduced in 2024. Take Action on SB 1059.

Cannabis taxes currently contribute more to California’s coffers than do alcohol taxes, despite far less sales. Gov. Newsom’s 2023/24 budget estimated an income of $440 million from alcohol taxes. By contrast, state excise taxes on cannabis brought in $624 million in 2023, and if that figure doesn’t rise to $670 million, we could see a rise in the 15% state excise tax on cannabis to as much as 19% come January 1, 2025.

The cannabis cultivation tax was eliminated through Assembly Bill 195, which was attached as a trailer to the California 2021-2022 budget; however, in a compromise with beneficiaries of cannabis tax money, the legislation included a provision to raise the cannabis excise tax rate to as much as 19% on Jan. 1, 2025, to make up for any losses from the cultivation tax being eliminated.

Specifically, the legislation determined a minimum baseline of $670 million in annual cannabis tax revenues to be allocated to Tier 3 entities—such as child care programs, environmental groups, youth prevention groups and law enforcement—in order to avoid the excise tax hike from 15% to 19%.

Overtaxation impedes legal, tested, and taxed cannabis access for consumers and fuels the illicit cannabis market. California’s cannabis consumers want access to safe, tested, and fairly taxed products.

Join Cal NORML with a business or personal membership and help us fight for cannabis tax fairness in California.

Also see:

Cal NORML’s White Paper: CA Cannabis Tax Fund Monies Diverted from Prop. 64 Mandates

As the California cannabis industry, already overburdened by overtaxation, faces a raise in the state excise tax from 15% to as much as 19% in order to fund programs that benefit from cannabis taxes, a sizeable chunk of the Cannabis Tax Fund is being diverted into programs not mandated for funding by Prop. 64.

Sure, California is a high tax state — but not when you’re buying beer and whiskey

California’s excise tax on beer ranked 30th among the 50 states and the District of Columbia, a new study from Washington’s Tax Foundation says. A separate report by the same research group found that California’s tax on distilled spirits ranked 40th.

Rescheduling is good news for California’s marijuana industry, but the state still needs to reduce regulations and taxes

While California’s marijuana businesses may gain critical relief from lower federal tax burdens, rescheduling cannabis won’t address the myriad other taxes, fees, and compliance costs imposed by state law. California’s cannabis dispensaries must also pay a statewide marijuana retail tax of 15%, a general sales tax of 7.25%, and local taxes in most jurisdictions. Cannabis companies also pay licensing and application fees.

State and local laws also impose elaborate rules on cultivation, retailing, transportation, manufacture, testing, facilities, security, environmental compliance, and other aspects of cannabis operations, all of which add to high start-up and operation costs that make it harder for new businesses to enter the market and nearly impossible to earn a profit.

Those tax and compliance costs get passed onto consumers. According to some estimates, taxes alone account for upwards of upwards of 40% of the final price of legal marijuana in California. Legal producers compete directly with illicit ones that have established market share over decades. Illicit cannabis operations are not subject to the taxes and compliance costs faced by their licensed counterparts and often offer lower prices to consumers. As a result, years after legalization, illegal sales continue to account for around two-thirds of marijuana sales in California.

15% of California Cannabis Businesses Default on Taxes as 2025 Hike Comes Knocking

This information on cannabis accounts receivable was shared with Cannabis Business Times via a California Public Records Act (PRA) request the CDTFA fulfilled for a client represented by Hirsh Jain, founder of industry consultancy Ananda Strategy, which represents many of California’s cannabis operators throughout the supply chain. Jain also is on the Cal NORML Board of Directors and serves as the vice chair of the California Cannabis Chamber of Commerce.

Cannabis dispensaries fight to stay afloat under layered taxation system

“The high tax rate assessed by state and local government is only fueling the continued illicit market,” Councilmember Valenzuela said. “It is hurting our young people as well as the business owners who are seeking to follow the law.”

There’s a big fight brewing over legal weed in California

California’s cannabis taxes have long been attacked for being unsustainably high, to the point that even state Attorney General Rob Bonta has called for lowering the burden. However, at least one powerful group in Sacramento is calling on the government to raise pot tax rates even higher.

CDTFA Releases Video Clarifying that Local Cannabis Taxes, Delivery Fees, Packaging Fees, etc. All Count as Gross Receipts for the Purposes of Charging 15% State Excise Tax