GOVERNOR SIGNS CANNABIS COMPASSION BILL

GOVERNOR SIGNS CANNABIS COMPASSION BILL

Governor Newsom has signed AB 2555, the cannabis compassion bill, as part of a package of bills supporting veterans in California.

The high cost of medical cannabis, particularly its taxation, has made it impossible for many patients who are financially challenged to obtain a sufficient and steady supply of their medicine.

SB 34 (Weiner, 2019), exempted cannabis donated to financially challenged patients from taxation. Provisions of that law will expire on March of 2025, and must be renewed, in order to continue to supply needy patients with cannabis. AB 2555 extends these critical donation programs for another five years.

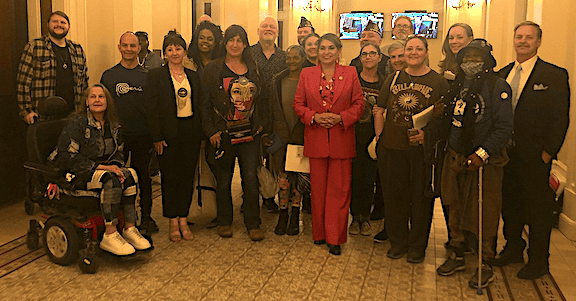

Veterans groups, patient advocates, and Cal NORML testified in its favor (pictured above with the bill’s author Asm. Quirk-Silva) at key hearings to win support for the bill. Thanks to all who took action! Nearly 1000 letters were sent in on this bill from Cal NORML supporters.

.jpg)

CANNABIS TAX RELIEF BILL SIGNED INTO LAW

Governor Newsom has signed SB 1059 into law, along with several other cannabis bills.

SB 1059 (Bradford amends the definition of gross receipts in the Sales and Use Tax Law to exclude the amount of any state cannabis excise tax and sales and use tax imposed on a cannabis retailer, preventing double taxation at the local level.

Cannabis is already heavily overtaxed relative to comparable goods in California. Compounding taxes simply leads to an artificially inflated purchase price and incentivizes consumers to purchase cannabis from the unlicensed, untested, and untaxed market.

The bill passed through the Asm. Rev & Tax committee on June 24 and the Asm. Business and Professions committee the following day, by a unanimous 18-0 vote. Testifying in favor of the bill was Cal NORML director Dale Gieringer, speaking about the unfairness of cannabis taxation and, addressing the committee analysis’s conclusion that only LA is doubly taxing cannabis, said that policies vary across the state; he showed a receipt from a Northern California dispensary that included excise and sales taxes in calculating local taxes.

Committee Chair Jacqui Irwin voted Yes on a “do pass” motion, mentioning she’d also like to see more enforcement to help the legal cannabis industry. Asm. Haney also voted yes and asked to co-author the bill. It was “on call” for a few minutes until Asm. Luz Rivas returned and cast the last needed Aye vote.

CANNABIS FARMERS’ MARKET BILL VETOED

CANNABIS FARMERS’ MARKET BILL VETOED

Governor Newsom has vetoed AB 1111, to allow small farmers to sell cannabis at farmers’ markets in California.

In his Veto message, he wrote, “While I appreciate the author’s intent to support small and equity cannabis cultivators, I am concerned that the bill’s broad eligibility, which extends to the vast majority of licensed cultivators, would undermine the existing retail licensing framework and place significant strain on the Department of Cannabis Control’s ability to regulate and enforce compliance. I remain open to considering a more flexible and narrowly focused version of this bill next year that can better respond to market dynamics, without imposing a rigid monitoring and compliance framework.”