UPDATE November 2021 – Voters in the city of Santa Cruz overwhelmingly passed a ballot measure upping the allocation of local cannabis tax monies from 12.5% to 20% for their Children’s Fund. Because it specifically allocated tax funds, the measure required a supermajority to pass, and won 83% of the vote. Read more.

June 18, 2020 – Two new reports, taken together, have found that California communities where huge racial disparities in marijuana arrests have been happening for decades are spending cannabis tax dollars to increase their police budgets since the passage of Prop. 64.

The two reports are:

• When the Smoke Clears: Racial Disparities in California’s Marijuana Arrests

co-authors Public Health Advocates, UC Davis Center for Regional Change, Million Dollar Hoods, UCLA with funding from The California Endowment.

• California Cannabis Tax Revenues: A Windfall for Law Enforcement or an Opportunity for Healing Communities?

co-authors Youth Forward and Getting it Right from the Start, a Project of the Public Health Institute

The authors released the reports in response to a pending state budget proposal to form a new police force focused on cannabis enforcement. “At a time when racial justice activists are calling to defund the police, these reports show how governments are turning to cannabis fees and revenues to expand law enforcement,” said a press release from Public Health Advocates. Additional materials are available at www.phadvocates.org/happening-now.

Arrest Disparities in Counties, Cities and Neighborhoods

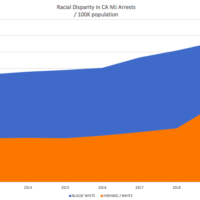

The first report, “When The Smoke Clears,” analyzes disparities in marijuana arrests at the county, city and neighborhood level for the years prior to cannabis legalization and reveals dramatic inconsistencies between marijuana-related arrest rates of black and white people in California communities. Statewide, black people were arrested four times more often as white people for marijuana offenses, with black arrest rates nearly 30 times higher in some communities, despite similar use rates between whites and blacks. The report is accompanied by an abbreviated version of a documentary with the same title, produced by the California Urban Partnership.

County-level data for each year from 2000 to 2016 shows that large counties made minor improvements in closing the black-white arrest gap, while smaller counties, including Amador, Butte, Nevada, San Benito, Shasta, Siskiyou and Tuolumne, saw an increase in black arrest rates, with marijuana-producing counties, like Mendocino and Humboldt, seeing the greatest increases. (Data in these smaller jurisdictions have a wider margin of error than larger jurisdictions.)

City-level data revealed significant variations between cities. For example, black Sacramento residents were arrested on marijuana-related charges 29 times more often than white residents—a disparity seven times the state average. On Sacramento’s heels were the cities of Palo Alto (26x), South Gate (26x), Oakland (25x), Berkeley (25x), Fremont (23x), South San Francisco (22x) and Citrus Heights (21x). Other cities with particularly high disparities include Indio (18x), Hemet (14x), Newport Beach (12x), Redwood City (12x), Alameda (12x), Richmond (11x), Santa Monica (10x), San Mateo (10x), San Francisco (10x) and Merced (9x).

The report also includes detailed census tract-level data for four agencies: Los Angeles Sheriff’s Department, Sacramento County Sheriff’s Department, Kern County Sheriff’s Department and Long Beach Police Department. These data show huge variations between black and white neighborhoods.

Police Benefit from Local Cannabis Tax Dollars

The second report, released by Youth Forward and Getting it Right from the Start (a project of the Public Health Institute), details how in cities and counties where local taxes have been enacted, revenue has been “a windfall for police departments across the state.” Between 2016-2017 (the year the Proposition was passed) and 2019-2020, 23 of the 28 cities researched experienced double-digit increases in the amount of general fund dollars going into their police budgets. Eight of the 28 saw their police budgets grow by at least 25%. Overall, the average shift in police budgets for these 28 cities was an increase of 19% over that 3-year period. Ultimately, in just those cities, over $455 million more in general fund dollars was spent on police in 2019-20 than was spent just three years earlier.

Recommendations in the report include investing tax revenues in communities of color and public health initiatives, and a restorative justice approach to bring underground operators into compliance, including priority licensing, technical assistance, and capital & regulatory relief. They suggest local grant programs along the lines of the state GoBiz and Dept. of Health Care services state grant programs, and requirements for employee quotas and shelf space for equity products for general operators.

Cal NORML Responds

“We are happy to see more scrutiny on the way that cannabis tax dollars are being spent in California, with Prop. 64’s goals in mind of bringing justice to those impacted by the War on Marijuana,” said Ellen Komp, deputy director of California NORML. Cal NORML’s next statewide Zoom meeting, on July 1 at 4 PM, will focus on Racial Justice, Equity and Cannabis.

A recent report from the ACLU found that nationally, disparities between arrests for blacks and whites for marijuana possession still exist in every state in the US; for California the disparity in possession arrests is 1.8 times as many for blacks (counting Latinx people as whites, as FBI data does), and the disparity is greater in many counties. Cal NORML compared ALCU data with numbers from the California AG and found that statewide, blacks were arrested 4.1 times as often as non-Hispanic whites for all marijuana crimes in 2018, two years after Prop. 64 passed.

July 1 is the deadline for District Attorneys to get information to county courts and public defenders regarding cases for which past marijuana convictions can be expunged or resentenced. It is also when the Board of State and Community Corrections is expected to release $24.7 million in grant funding from last year’s state budget for jurisdictions that license cannabis retailers and allow outdoor personal cannabis cultivation, a “carrot” that was included in Prop. 64 to encourage local licensing. Those grants can be used for public services, including police, and must include a component addressing youth development, drug prevention and intervention. [UPDATE: The release of BSCC grants has been delayed until its Sept. 10 board meeting, or until October.] The state has yet to award $20 million in public university grants that have accrued under Revenue and Taxation Section 34019(b) from Prop. 64, nor has it issued a report on the need for nonprofit collectives that the BCC needed to complete by January 1, 2020 (originally 1/1/2018 in Prop. 64).

Cal NORML has released a Local Activist Toolkit to assist locals in watchdogging cannabis reform efforts in their communities.